Make Dynamic Life Capital

your trusted investment manager

Our lasting industry relationships and unique expertise in Actuarial and Medical Underwriting provide the right combination to aggregate superior, analytically driven portfolios.

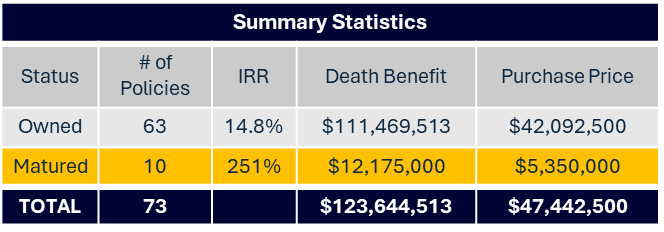

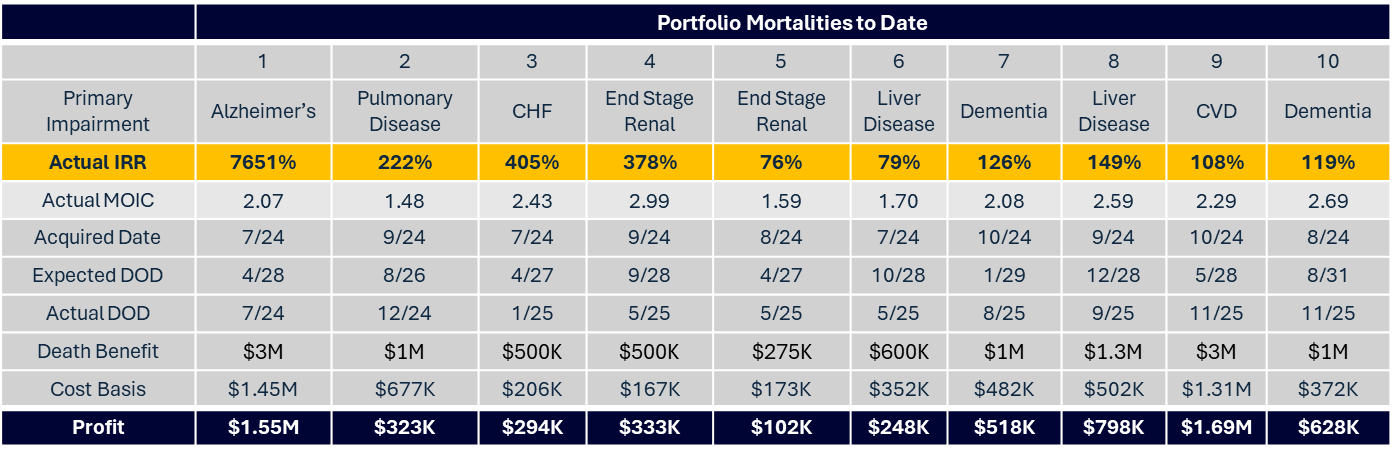

Policies Aggregated For The Fund

Dynamic Life has priced and underwritten policies representing approximately $50M in a strategic investment. Certain policies from this investment may be identified1 and used for immediate deployment. Our strong relationship with originators and the advanced stage of policy readiness can significantly accelerate capital deployment and help minimize the cash drag often associated with the asset class.

A Commitment to Deeper Analytics

This unique blend of experience and expertise allows us to meticulously select only the most desirable assets.

Why work with us?

The Dynamic Advantage

Projected Double Digit, Uncorrelated Returns

12.5%-14.5% Projected Gross IRR2, 11.5%-13.5% Net. Projected MOIC 1.5-2.2x

Investments are mostly unaffected by market volatility and encourage overall portfolio diversification.

Actuarial Expertise

Medical Underwriting Expertise

Minimal Cash Drag

Dynamic Life has priced and underwritten policies representing approximately $50M in a strategic investment. Certain policies from this investment may be identified1 and used for immediate deployment into DLIF. Our strong relationship with originators and the advanced stage of policy readiness can significantly accelerate capital deployment and help minimize the cash drag often associated with the asset class.

Strategic Market Access

Anchor Investor

What is a Life Settlement?

The investor becomes the new owner of the policy and is responsible for paying future premiums until the insured passes away. At maturity, the investor receives the death benefit from the insurance company.

Though life settlements have been legalized since 1911, the majority of transactions have occurred in the last 20 years. The market is now regulated in 45 of the 50 U.S. states, covering approximately 95% of the U.S. population.

- Settlement investing is socially responsible and is aligned with Environmental, Social and Corporate Governance (ESG) principles.

- Insurance agents have a responsibility to inform their customers of alternatives to lapsing or surrendering their policy.

- Recent tax reforms allow for more favorable tax treatment for policyowners who sell their policy.

- According to the Life Insurance Settlement Association (LISA), total payments to policyowners have increased each year since reporting began in 2021, providing additional funds to seniors and their families.

Meet The TeamS

Leadership Team

Denny Mathew, ASA, MAAA

Managing Partner, Chief Executive Officer

Mr. Mathew brings more than 20 years of extensive and broad knowledge in the insurance industry to Dynamic Life Capital as the Managing Partner and Chief Executive Officer.

Prior to starting Dynamic Life Capital, Mr. Mathew was the Chief Underwriting Officer at RiverRock Investment Funds, aggregating policies and managing over $200m of AUM across 2 funds.

Prior to joining RiverRock in 2017, Mr. Mathew served as a Pricing Actuary and Head of the Life Settlements division at AmTrust Financial, where he managed portfolios with Face Value exceeding $1.6b. Mr. Mathew started his career at RMS where he earned his certification as a Certified Catastrophe Risk Analyst (CCRA).

Mr. Mathew holds a Masters in Actuarial Science at the University of Central Florida, and a BSBA at the University of Florida. He is an Associate of the Society of Actuaries (ASA), a Member of the American Academy of Actuaries (MAAA) and holds the Series 65 license.

Darryl Glatthorn

Partner, Senior Advisor, Chief Compliance Officer

Mr. Glatthorn’s recent professional experience includes over 20 years on the investment side of the life settlement industry. Between 2015 and 2019, he was the CEO of RiverRock Funds, a private equity manager with a series of life settlement funds focused on small face.

Within the institutional market for life settlements, he’s worked with Apollo Group, Nomura Securities, Plainfield Asset Management, Obra Capital and a number of licensed providers in the industry. He founded a FINRA licensed broker dealer, Equus Financial, which still operates in 47 states.

Mr. Glatthorn spent eight years as a partner and Head Trader at Zweig DiMenna Associates, a New York-based hedge fund dedicated to equity investing. Earlier in his career, Mr. Glatthorn was employed at UBS/PaineWeber in equity derivatives sales and in institutional equity sales at Morgan Stanley and Lehman Brothers.

Mr. Glatthorn is a graduate of Babson College where he majored in accounting and went on to become a Certified Public Accountant (inactive). He holds the Series 7, 24, 63 and 79 licenses.

Operating Team

Kyle Lester, CPA, PC

Chief Financial Officer

Mr. Lester has over 30 years of experience in private practice as an attorney and a CPA offering a full suite of services in taxation, estate planning, accounting, etc. He is a highly experienced professional with a diverse background in business, law, and accounting. He earned a Bachelor in Business Administration from Hofstra University and a Juris Doctor from Touro Law School. He is both a Certified Public Accountant (CPA) and an attorney licensed in New York.

Throughout his career, Mr. Lester has worked with several accounting firms, including the international firm BDO Seidman He also spent twelve years as an adjunct lecturer in accounting at College University of New York

Sachin Jacob

Actuarial Analyst

Mr. Jacob is an Actuarial Analyst at Dynamic Life Capital, where he brings a strong foundation in quantitative risk and insurance. He started his career as an Underwriter at GNY Insurance Companies and now supports pricing, valuation, and risk analysis while collaborating with external providers.

Mr. Jacob holds a Bachelor’s degree in Actuarial Science from St. John’s University and has successfully completed Exams P and FM. He is actively pursuing further actuarial credentials through the Society of Actuaries.

Senior Medical Team

Brian Rosenswike

Director of Medical Underwriting

Mr. Rosenswike has worked in the life settlement industry since 2006, providing underwriting evaluations for life settlement investment managers and life expectancy services. Prior to joining Dynamic Life Capital, he worked as Director of Medical Underwriting for RiverRock Funds where he prepared internal underwriting assessments for policy acquisition and portfolio management. He also worked in a similar capacity with Obra Capital and Magna Life Settlements. He has more than 10 years combined experience as a Senior Underwriter with AVS and LSI, supplying the market with thousands of life expectancy reports during that time.

Mr. Rosenswike earned a Bachelor of Science and Master of Science from the University of Georgia.

Dr. Blessan Thomas, DABFM

Board-Certified Family Medicine Physician*

Dr. Thomas is a Board-Certified Family Medicine Physician practicing for over 8 years. Dr. Thomas has a passion and focus on preventive medicine and a holistic approach to patient care.

After completing medical school at St. James School of Medicine, Dr. Thomas pursued residency training in Family Medicine at Heritage Valley Healthy System in Beaver, PA.

Dr. Jackson Shaji, DO

Board-Certified in Internal Medicine and Nephrology*

Dr. Shaji has been in active practice for more than 9 years. He received his medical degree from New York College of Osteopathic Medicine. Dr. Shaji subsequently completed his Internal Medicine residency at New York Presbyterian in Flushing, New York and Nephrology Fellowship at The State University of New York Downstate and Westchester Medical Center.

Dr. Shaji has been reviewing and providing internal medical reviews for the Life Settlement Industry since 2018.

Dr. Joel Jacob, FACP

Board-Certified in Internal Medicine*

Dr. Jacob is a Board-Certified Physician practicing medicine for over a decade. He received his Bachelor of Science Degree from New York Institute of Technology. He went on to get his Doctor of Medicine Degree from Ross University School of Medicine.

He is a Diplomat of the American Board of Internal Medicine. He is also a Fellow of the American College of Physicians.

*All Board-Certified Physicians are full-time Physicians and support Dynamic Life Capital on a case-by-case basis.